Are There Tax Advantages to Solar Power?

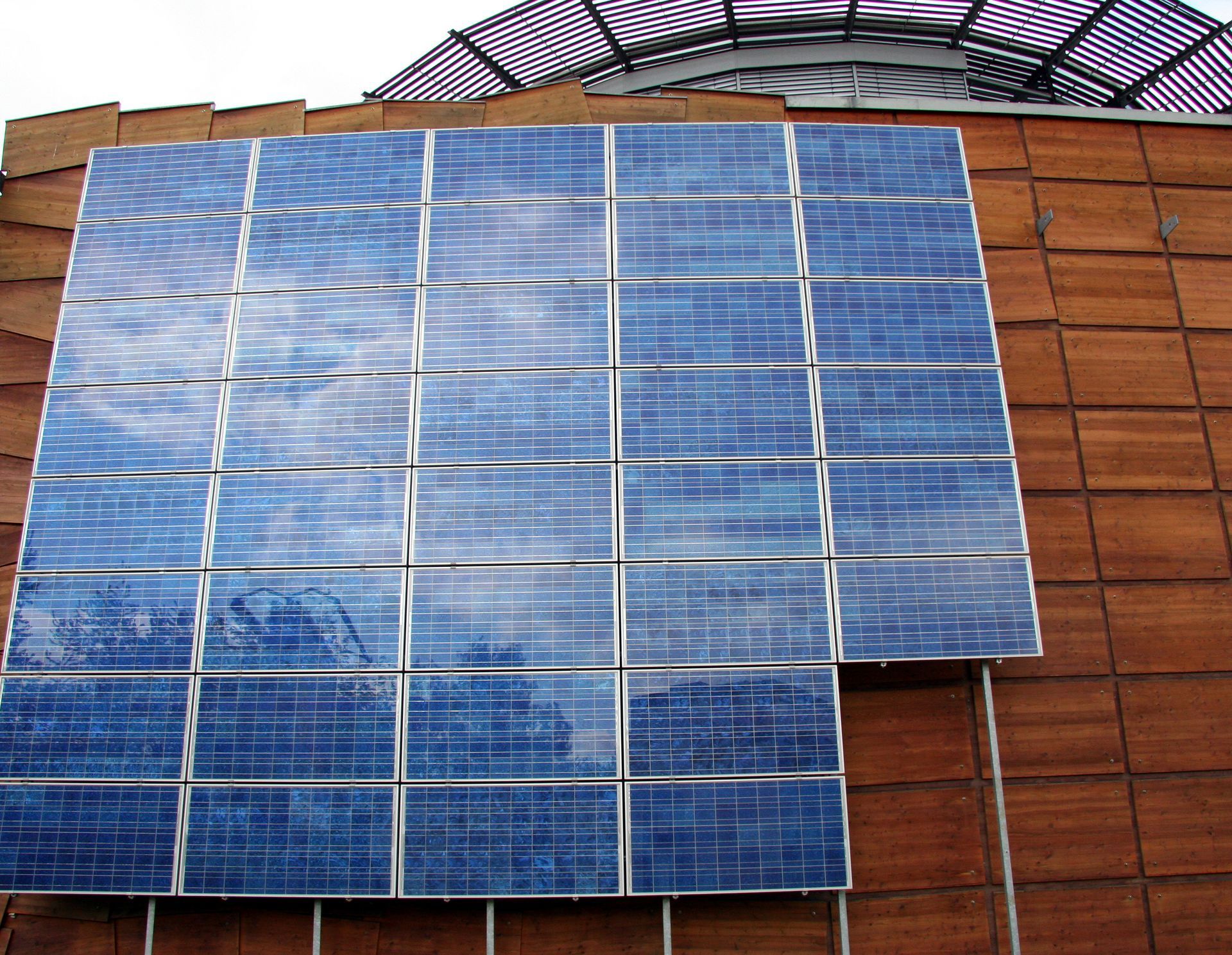

According to Energy.gov, over 3% of all electricity in the United States is derived from solar power via solar photovoltaics (PV) and concentrating solar-thermal power (CSP). Americans know that solar power benefits the planet and can lower utility bills, but are there tax advantages to solar power? In this article, we'll go over everything you need to know about solar power and its tax advantages.

Federal Solar Tax Credit

This tax credit is one of the biggest tax advantages to solar power. The year you install your solar power, you will qualify for a federal tax credit in the United States. This won't automatically give you a refund for the money you spend on your solar panels. However, it will lower your tax bill, making you pay less taxes. This credit is only applicable the year that you install solar power, and the solar equipment must give electricity to a house in the United States.

State Solar Tax Credits

Many states offer a similar tax credit to homeowners who install a solar system or solar products, such as a solar water heater. However, this number and the percentage of the system that you receive a tax credit for varies depending on the state that you live in. It's important to discuss the tax advantages of solar with an accountant or research the tax laws in your state to determine how much of a credit you'll receive.

Other Solar Incentives

As the government continues to push for more solar power, many states offer incentives to homeowners who install a solar system. Many states offer rebates and renewable energy certificates as further incentives to install solar power. Some states will not include the installation of solar power in the value of your house, ensuring that your property tax does not go up. States may offer solar systems tax-free, meaning you don't have to pay sales tax to reduce the cost.

Solar power offers many benefits, and it also has tax advantages. If you're willing to make the initial investment, you can see great benefits in the long run. When you're ready to leap into solar power, call Northwind Solar today! We are more than happy to answer any questions you have about the tax advantages to solar power.

Share On: